Economic uncertainty has become a perpetual companion in modern times. It’s like having a nagging question mark hovering over your head, wondering when the next unexpected twist will strike. But amidst all this chaos, one thing remains constant: inflation. In this article, we’ll delve into the world of economic uncertainty and explore how it affects your wallet – and why you shouldn’t panic just yet.

High inflation creates uncertainty and reduces household demands …

The Rise of Inflation: A Historical Perspective

Inflation has been a persistent issue throughout human history, with varying degrees of severity. However, in recent years, we’ve seen a significant spike in inflation rates worldwide. According to the International Monetary Fund (IMF), global inflation peaked at 8.9% in 2021, with some countries experiencing inflation rates as high as 20-30%. But what’s driving this trend, and how will it impact your wallet?

The Effects of Inflation on Your Wallet

Inflation is like a silent thief, stealing away the value of your hard-earned cash. When prices rise, the purchasing power of your money decreases. For example, let’s say you’ve been saving up for a dream vacation and finally have enough money to afford it. But due to inflation, the price of that vacation has increased by 10%. Suddenly, your $1,000 doesn’t go as far as it used to. You might need to save an additional $100 just to maintain the same standard of living.

The Psychology of Inflation: How It Affects Your Spending Habits

Inflation has a profound impact on our spending habits. When prices rise, we tend to become more cautious with our finances. We start to prioritize needs over wants and make adjustments to our budgets accordingly. However, this can lead to a vicious cycle of reduced spending, which in turn fuels inflation even further.

The Silver Lining: How Inflation Can Boost Savings

While inflation might seem like a cruel joke, it also presents an opportunity for savvy investors and savers. When interest rates are low, people tend to hoard cash rather than invest it. But when inflation rises, the value of your savings increases. This means you can earn more from your money by investing in assets that historically perform well during periods of high inflation, such as precious metals or real estate.

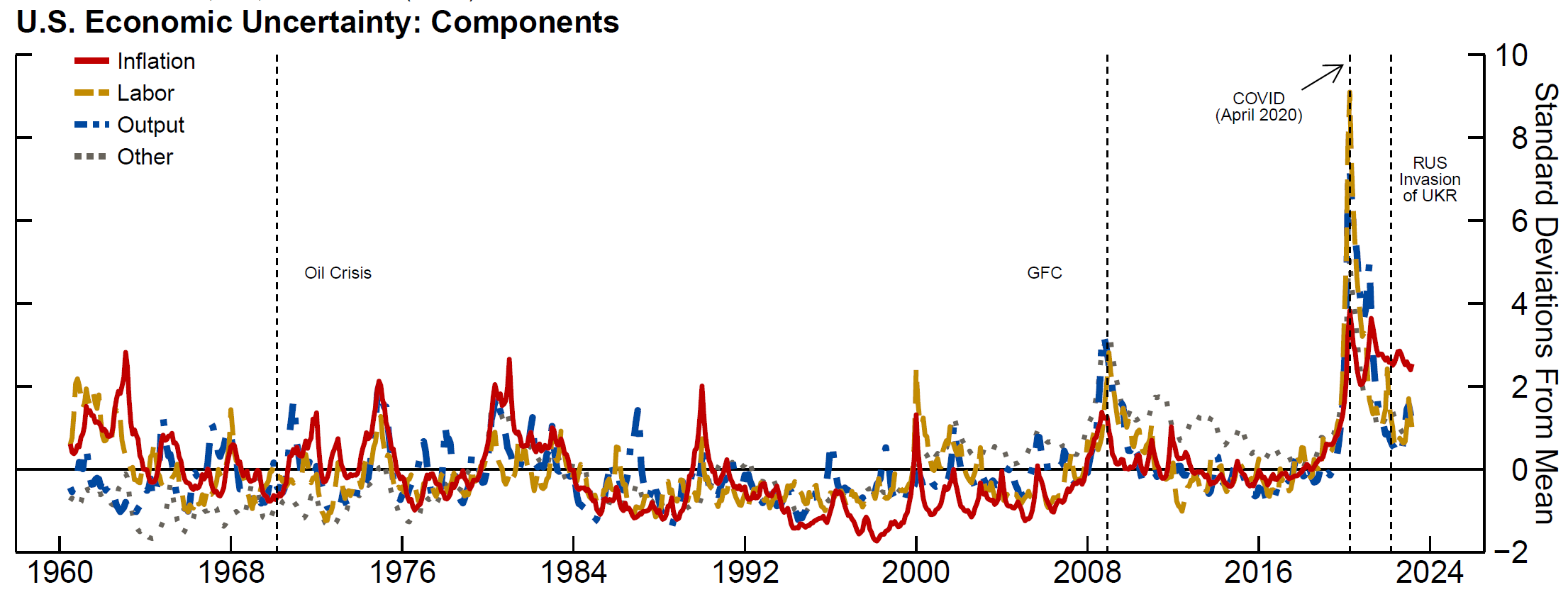

The Fed – Global Inflation Uncertainty and its Economic Effects

The Impact on Small Businesses and Entrepreneurs

Small businesses and entrepreneurs are often the most vulnerable to inflation’s effects. With rising costs for materials, labor, and rent, it can be challenging to maintain profitability. However, this doesn’t mean they should panic. By adopting strategies such as price indexing, cost reduction, and diversification, small businesses can adapt to the changing economic landscape.

The Role of Central Banks: How They’re Fighting Inflation

Central banks have traditionally used monetary policy to combat inflation. By adjusting interest rates, they aim to reduce borrowing costs and curb demand for goods and services. However, this approach has its limitations. With inflation rates running high in some countries, central banks are facing a tough decision: balance the need to control inflation with the risk of causing economic downturns.

The Future of Inflation: Will We See a Recession?

As we navigate these uncertain times, one question lingers on everyone’s mind: will we see a recession? While it’s impossible to predict with certainty, economists point to several warning signs. A sharp decline in consumer spending, rising unemployment rates, and a surge in debt defaults are all potential indicators of a looming recession.

Conclusion: Don’t Panic – Adapt

In conclusion, economic uncertainty is here to stay – at least for the foreseeable future. Inflation will continue to affect your wallet, but it’s not an insurmountable challenge. By understanding its effects on your spending habits, investing in assets that historically perform well during periods of high inflation, and adopting strategies such as price indexing and cost reduction, you can adapt to this new economic reality.

Takeaways:

- Inflation might seem like a constant companion, but it’s not the end of the world. By understanding its effects on your wallet and adapting to the changing landscape, you can navigate these uncertain times with confidence.

- Savings become more valuable during periods of high inflation. Consider investing in assets that historically perform well during this time.

- Small businesses and entrepreneurs need not panic. By adopting strategies such as price indexing and cost reduction, they can adapt to the changing economic landscape.

In a world filled with uncertainty, one thing remains constant: your ability to adapt. Don’t let inflation hold you back – embrace it as an opportunity to grow and thrive in these unpredictable times.

Gold Prices Surge Amid Economic Uncertainty and Inflation Fears …

Finishing the Job and New Challenges | Hoover Institution

Increase Wealth & Cash Flow – The Money Advantage Blog for …